Our History

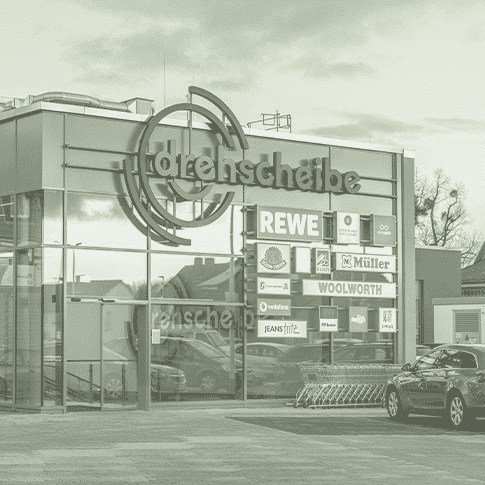

Since 2005 Greenman has evolved into a market-leading, sector specific, real estate investment fund manager. We have shown our commitment to our sector, our tenants and our people and have continued to deliver long-term, sustainable income to our investors.