Greenman OPEN agrees new debt deal for a sustainably constructed retail park in Rhineland-Palatinate

- Debt deal for a new sustainably constructed retail park in Höhr-Grenzhausen, Rhineland-Palatinate

- Bank consortium deal led by Westerwald Bank eG, with participation of Nassauische Sparkasse (Naspa) and Sparkasse Westerwald-Sieg

- Forward fixing loan with seven-year term

- Modern project development with approx. 14,000 square metres of rental space opens in the first quarter of 2023

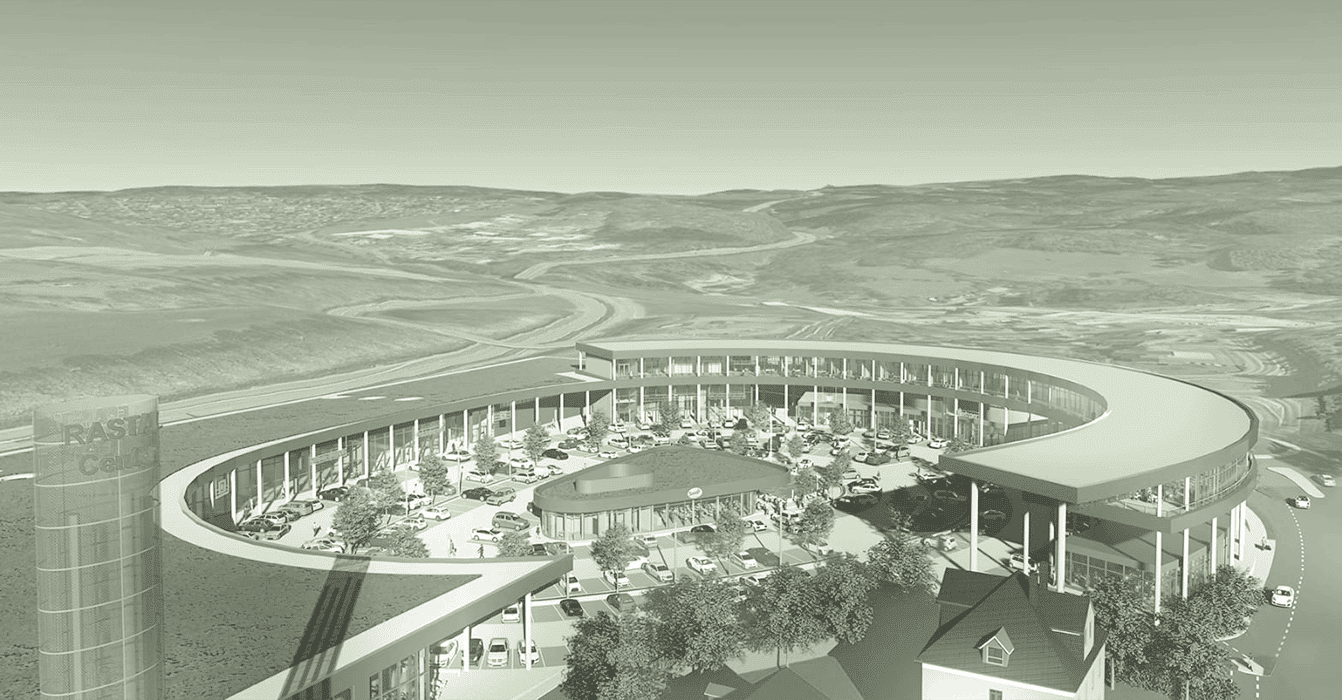

Greenman OPEN (OPEN), one of the largest food retail-focused investment funds in Germany, has successfully signed a new €24.2 million forward fixing loan for the acquisition financing of a new turnkey retail park in Höhr-Grenzhausen (Rhineland-Palatinate) with a consortium comprising Westerwald Bank eG, Nassauische Sparkasse (Naspa) and Sparkasse Westerwald-Sieg. The anchor tenants for the retail park, which is targeting a Silver DNGB rating once complete, will be Germany’s leading food retail discounters LIDL and ALDI.

Neil Hennessy, Head of Debt Capital Markets at Greenman, says: “We are delighted to have gained another three new traditional financing partners – Westerwald Bank eG, Nassauische Sparkasse and Sparkasse Westerwald-Sieg. With the addition of the retail park in Höhr-Grenzhausen to OPEN’s portfolio, we are strengthening our investors’ access to attractive and stabilised returns whilst supporting our fund’s target of a carbon neutral portfolio.”

Wilhelm Höser, managing board spokesman at Volksbank Westerwald Bank eG (Montabaur) added, “We are pleased to be able to support the investment and food retail specialist Greenman with its continued growth in Germany.”

As a certified “Light Green” fund under Article 8 of the EU Sustainable Finance Disclosure Regulation, ESG factors are an integral part of OPEN’s investment and development process and play an important role in future-proofing investments. The fund is increasingly investing in sustainable real estate in order to meet its target to become carbon-neutral by 2040. It currently has a volume of €1.05 billion under management. The properties in the fund operate with long-term leases and offer investors a regular and secure income.

OPEN was legally advised on the financing by the Berlin law firm

BOTTERMANN::KHORRAMI.