Greenman agrees €143m purchase

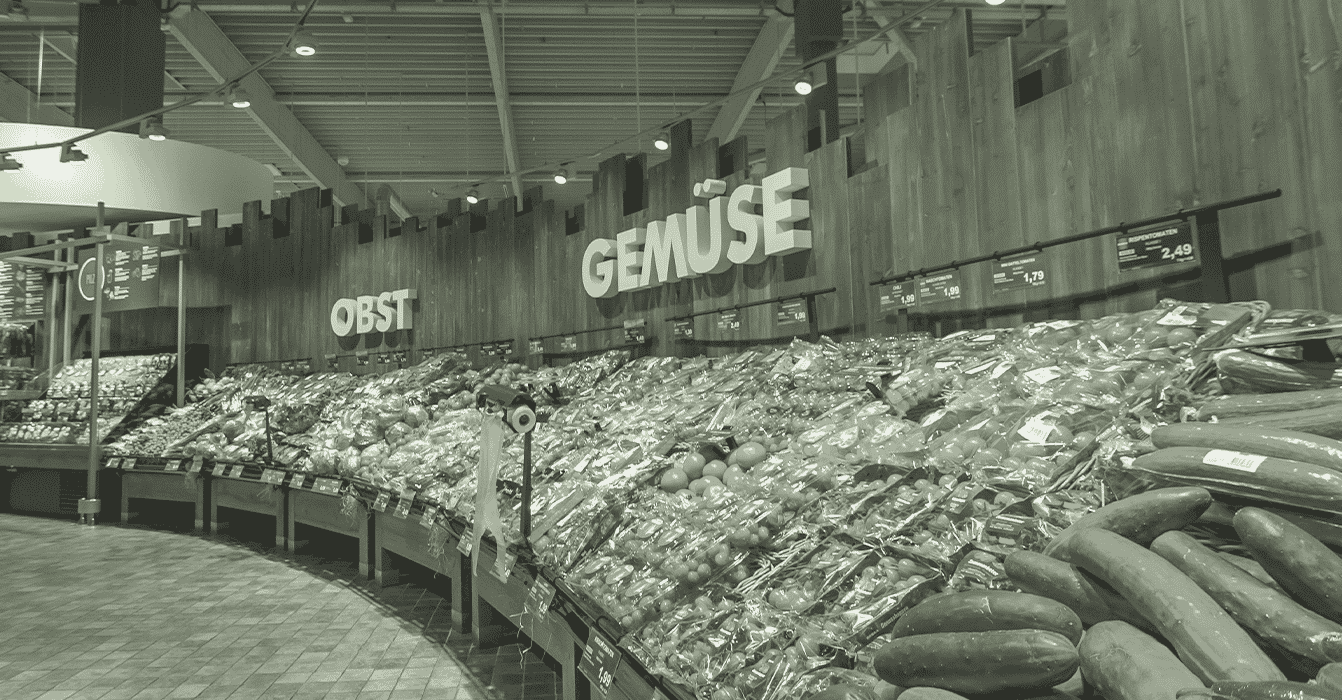

Greenman, the German specialist food retail real estate investment fund manager, has agreed to acquire 33 Edeka MIHA-anchored retail properties for its Greenman OPEN fund in two separate deals with a combined value of €143m.

Including these acquisitions, Greenman has increased the volume of Greenman OPEN’s assets to c. €570m, making it Germany’s largest food retail focused investment fund.

Greenman has acquired four properties from EDEKA MiHa for c. €25 million in a sale and lease back transaction. The new lease contracts vary in length but have a WARLT (weighted average remaining lease term) of 11.5 years. Three of the properties will be sub-let by EDEKA MiHa to their cash and carry brand MIOS.

By acquiring the MIOS centres, Greenman OPEN now owns properties that span each of EDEKA’s operational brands and will have the opportunity to witness at “first hand” how EDEKA’s various retail concepts develop in the long term.

Greenman OPEN has also purchased a portfolio of 29 EDEKA MiHa supemarkets for a combined purchase price of €118 million from TLG IMMOBILIEN. The properties are 100% occupied on long-term leases with an average WARLT of 11.28 years and in some cases include redevelopment provisions.

Johnnie Wilkinson, CEO and Executive Director of Greenman Investments, commented: “Our latest purchases for the Greenman OPEN fund complement our existing portfolio of food-dominated retail stores across Germany.

“This is our 4th sale and lease back transaction with EDEKA MiHa and we look forward to developing our long-standing relationship with EDEKA and maximising the potential of this portfolio in the coming years”.

Greenman was advised by White & Case on the legal aspects of both deals, by REAG on the technical due diligence for both deals, by Mazars and Trinavis on the tax and structural aspects of the acquisitions.