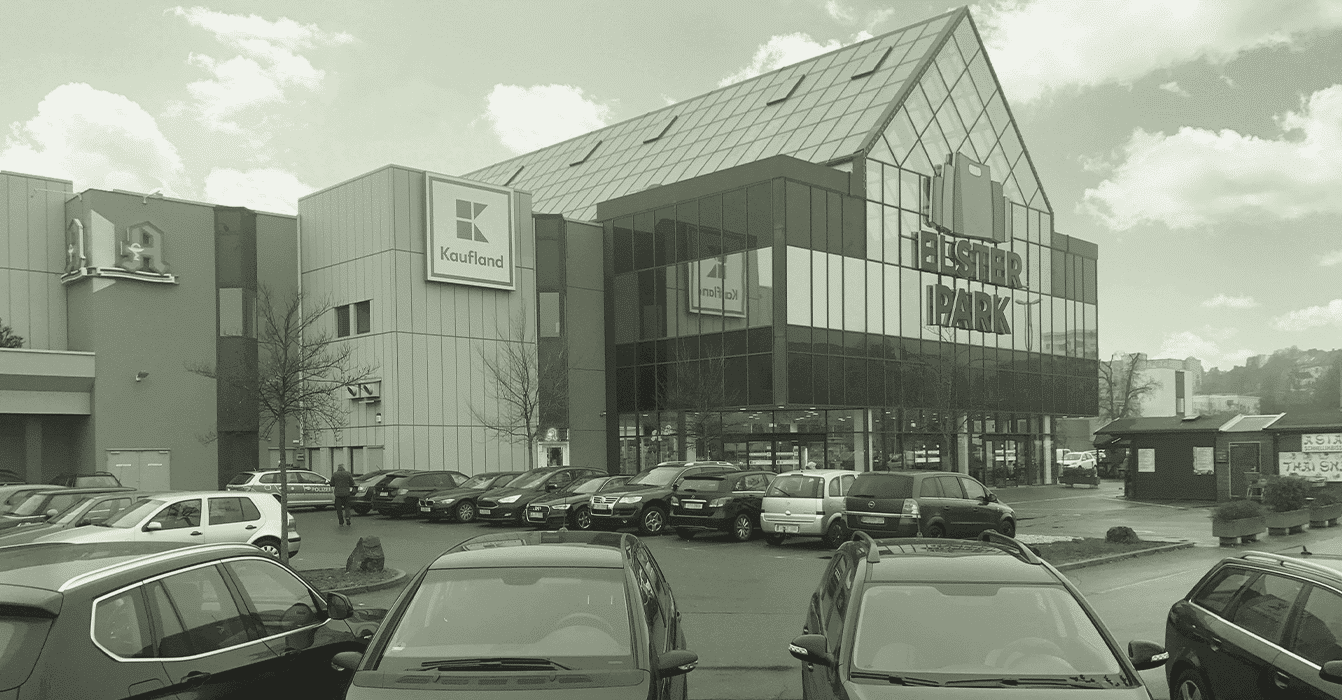

Greenman OPEN’s portfolio expands with the acquisition of a c. €112m portfolio of Kaufland anchored retail centres.

Greenman OPEN has notarised a deed to acquire 5 food-anchored retail properties with a combined purchase price of c. €112m, increasing its portfolio value to c. €707m and consolidating its position as Germany’s largest food retailer focused investment fund.

The newly acquired assets comprise a portfolio of 5 Kaufland-anchored properties with a total lettable area of c. 71,400 sqm in North East Germany with Kaufland meeting c.74% of the portfolio’s annual rental income. The addition of five Kaufland-anchored properties in the latest transaction strengthens Greenman’s relationship with Kaufland who now become the fund’s third largest tenant after EDEKA and REWE.

Commenting on the acquisitions, James McEvoy, Head of Acquisitions for Greenman, says: “By acquiring these, recently unloved, centres and extending our relationship with Kaufland we look forward to solidifying these centres’ position in their catchment for the long term”.

For this transaction Greenman OPEN’s advisors were Mayer Brown (legal advice and due diligence) and Duff & Phelps (technical due diligence).